Introduction

In the land of opportunity, where the American Dream has been a beacon of hope for generations, a surprising trend is emerging in 2024 – the rise of financial insecurity. This concept, often associated with uncertainty about one’s ability to meet basic financial needs, is becoming an increasingly common part of Americans’ lives.

Financial insecurity is not just about numbers on a bank statement. It’s about the stress of living paycheck to paycheck, the anxiety of unexpected expenses, and the fear of not having enough for the future. It’s about parents lying awake at night worrying about how to pay for their children’s education, and retirees wondering if their savings will last through retirement.

Contrary to the past perceptions of the US economy as a powerhouse of wealth and prosperity, financial insecurity is on the rise. This is not just a statistic or a headline. It’s a reality for millions of Americans, and its effects are far-reaching and deeply personal.

The year 2024 is not just a date on the calendar. It’s a call to attention, a reminder that this issue is not a distant problem of the future, but a pressing concern of the present. As we delve deeper into this topic, we invite you to join us in exploring the causes, implications, and potential solutions to this growing issue. Together, we can face financial insecurity head-on and work towards a future where every American has the opportunity to achieve financial security.

Evidence of Growing Financial Insecurity

The evidence of growing financial insecurity in America is both startling and concerning. A multitude of recent surveys and statistics paint a picture of a nation grappling with financial anxiety.

Surveys and Statistics on Financial Insecurity

According to a 2024 Planning & Progress survey by Northwestern Mutual, feelings of financial insecurity among Americans have reached their highest point in at least a decade. (credits) This survey revealed that a third of American adults do not feel financially secure, a significant increase from the previous year.

Living Paycheck to Paycheck

A particularly alarming statistic is the number of Americans living paycheck to paycheck. A 2023 survey conducted by Payroll.org highlighted that 78% of Americans live paycheck to paycheck, a 6% increase from the previous year. This means that more than three-quarters of Americans struggle to save or invest after paying for their monthly expenses. (credits)

Struggling with Debt

When it comes to debt, the situation is no less dire. Data from a 2023 report by USA Today indicates that the average American held $101,915 in debt. Furthermore, a report by Money reveals that 40% of Americans are having trouble paying their bills. (credits 1, 2)

News Articles and Social Media Trends

News articles and social media trends further underscore this growing concern. Reports on financial insecurity hitting a new high are becoming increasingly common. On social media, discussions around financial insecurity are prevalent, with a Bankrate survey revealing that 47% of Gen Z social media users and 46% of millennial users experienced negative feelings about their finances after viewing others’ posts.

In conclusion, the evidence of growing financial insecurity in America is clear and compelling. The next sections will delve deeper into the factors contributing to this issue and the human cost of financial insecurity.

Factors Contributing to Financial Insecurity

There are several factors contributing to the rise of financial insecurity in America. Let’s delve into each one:

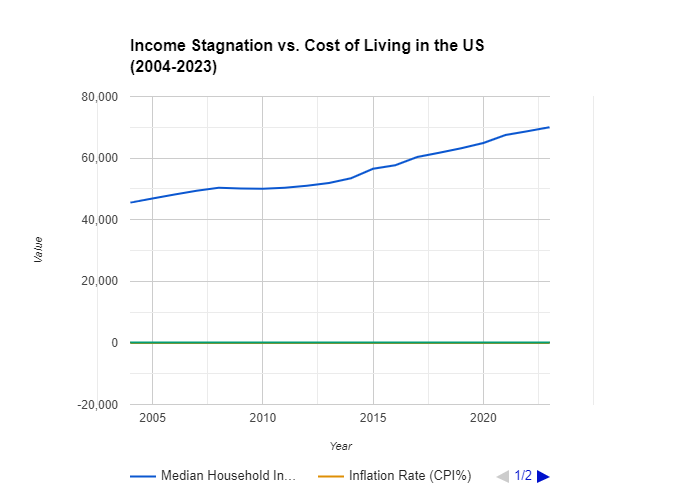

Rising Inflation and Cost of Living

In 2024, the cost of living in America has been a significant concern. Surveys show that Americans rank inflation as one of the top problems facing the country. Prices continue to soar in nearly every aspect of life—from groceries to transportation to housing. The rate of inflation exceeded the growth of wages for the first time in recent years in April 2021. In January 2024, inflation amounted to 3.1 percent, while wages grew by five percent.

Stagnant Wages

Despite the level of wage growth reaching 6.7 percent in the summer of 2022, it has not been enough to curb the impact of even higher inflation rates. The federally mandated minimum wage in the United States has not increased since 2009. This means that individuals working minimum wage jobs have taken a real terms pay cut for the last twelve years.

Increasing Student Loan Debt Burden

The student loan debt balance in the U.S. has increased by 66% over the past decade, and it now totals more than $1.77 trillion. More than 92% of this is federal student loan debt while the remaining amount is owed on private student loans. This increasing student loan debt burden is another factor contributing to financial insecurity.

The Changing Nature of Work

The landscape of work in 2024 is heavily influenced by technological advancements, particularly automation and artificial intelligence (AI). These advancements have shifted the focus from manual and repetitive tasks to more complex, cognitive functions. The rise of the gig economy and job insecurity are also contributing factors.

Unexpected Economic Events

Unexpected economic events such as supply chain disruptions have also contributed to financial insecurity. These disruptions can lead to increased prices and job losses, further exacerbating financial insecurity.

In conclusion, these factors interplay to create a complex web of financial insecurity. Understanding them is the first step towards finding solutions and strategies for building financial security.

| Debt Category | Statistics |

| Total | $1.75 trillion (Q4 2023) |

| Average per Borrower | $38,792 (Q4 2023) |

| Average per Household | $11,319 (Q4 2023) |

| Total National | $1.13 trillion (Q4 2023) |

| Student Loans (>90 days late) | 7.4% (Q4 2023) |

| Credit Cards (>30 days late) | 4.33% (December 2023) |

The Human Cost of Financial Insecurity

Financial insecurity is not just a matter of numbers and statistics. It has real-life consequences that extend far beyond the realm of personal finance, affecting mental and physical health, relationships, and overall well-being.

Impact on Mental and Physical Health

Financial insecurity can have a profound impact on mental health. According to a study published in PLOS ONE, financial health underlies all facets of daily living and is strongly associated with mental health outcomes. Financial stress can lead to anxiety, depression, and even physical symptoms like stomachaches or headaches. Chronic financial stress has also been linked to serious health conditions such as migraines, heart disease, diabetes, and sleep problems.

Impact on Relationships and Overall Well-Being

The stress and anxiety caused by financial insecurity can strain relationships, leading to social withdrawal and isolation. It can also affect overall well-being, leading to feelings of hopelessness and despair. Financial stress can cloud our judgment and lead to impulsive decisions that can have damaging consequences on our finances. (credits)

Social Implications

The social implications of financial insecurity are far-reaching. Homelessness and the criminal justice system are deeply intertwined, with people experiencing homelessness more likely to interact with the justice system. Rising homelessness can harm entire communities, not just the persons experiencing homelessness. It increases financial and staffing demands on local governments and nonprofit organizations that manage shelters and provide food assistance and other social services.

In conclusion, the human cost of financial insecurity is significant and multifaceted. It’s a reminder that behind every statistic, there’s a human story of struggle and resilience. As we continue to explore this issue, it’s crucial to keep these human costs at the forefront of our minds.

Geographic Disparities in Financial Insecurity

Financial insecurity is not evenly distributed across the United States. It tends to be more prominent in certain regions or demographics, such as rural areas, low-income communities, and specific age groups. This section explores these disparities and discusses the factors contributing to them.

| Statistic | Description |

| Top 1% vs Bottom 50% Wealth Share | The top 1% of earners hold a significantly larger share of wealth compared to the bottom 50%. As of Q4 2021, the top 1% held 32.3% of the wealth, while the bottom 50% held only 2.6%. Source: Federal Reserve: https://www.federalreserve.gov/ |

| Gini Coefficient | The Gini coefficient is a measure of income inequality, where 0 represents perfect equality and 1 represents perfect inequality. In the US, the Gini coefficient has been steadily rising, indicating a more unequal distribution of wealth. A 2022 report suggests the coefficient is around 0.8, which is very high compared to other developed nations. Source: World Inequality Lab: [invalid URL removed] |

Rural Areas

Rural areas often face unique challenges that can contribute to higher levels of financial insecurity. These include limited job opportunities, lower incomes, and higher poverty rates. Additionally, rural residents have reported higher levels of financial insecurity compared to their urban counterparts. (credits)

Low-Income Communities

Low-income communities are particularly vulnerable to financial insecurity. The rising cost of living and stagnant wages have left many low-income households with little to no financial slack. Furthermore, these communities often lack access to affordable credit, which can exacerbate financial insecurity.

Specific Age Groups

Financial insecurity can also vary by age group. For instance, younger generations such as Gen Z and Millennials have reported higher levels of financial insecurity compared to older generations. This could be due to factors such as student loan debt, early career low wages, and the high cost of housing.

Contributing Factors

Several factors contribute to these geographic disparities in financial insecurity:

- Job Opportunities: Regions with fewer job opportunities or lower wages can lead to higher levels of financial insecurity. This is particularly true in rural areas, where job opportunities may be limited.

- Cost of Living Variations: The cost of living can vary significantly across different regions. High costs of living, particularly in areas with low wages, can lead to increased financial insecurity.

- Access to Social Safety Nets: Access to social safety nets can play a crucial role in mitigating financial insecurity. However, the strength of these safety nets can vary by region, with some areas offering more robust support than others.

In conclusion, understanding these geographic disparities in financial insecurity is crucial for developing targeted policies and interventions. By addressing the unique challenges faced by rural areas, low-income communities, and specific age groups, we can work towards reducing financial insecurity across all regions and demographics.

Are We Headed for a Financial Crisis?

As we grapple with the rising tide of financial insecurity, a question that naturally arises is whether we are headed for a financial crisis or recession. This is a complex issue with varying opinions among financial experts and economists.

Potential Recession or Economic Downturn

The potential for a recession or economic downturn in 2024 is a topic of ongoing debate among economists. Some experts, such as those at TD Securities, estimate the odds of a U.S. recession at around 65%, citing interest rate effects, risk of government shutdown, and a weaker labor market as the causes. However, others, including the former Dallas Fed president, suggest that there is a ‘good possibility’ we won’t have a recession in 2024. (credits)

Opinions of Financial Experts and Economists

Economists at J.P. Morgan expect real GDP growth to walk the line between a slight expansion and contraction for much of 2024, also known as a soft landing. They forecast a below-trend 0.7% pace of expansion in 2024. The World Economic Forum’s latest Chief Economists Outlook finds that just over half of chief economists anticipate the global economy to weaken this year.

A Balanced Perspective

While these predictions may seem alarming, it’s important to maintain a balanced perspective. Economic recessions have been a regular occurrence over the past century. They are part of the natural cycle of the economy and often lead to periods of economic growth and expansion.

In conclusion, while there are concerns about a potential recession or economic downturn, the opinions among financial experts and economists vary. It’s crucial to stay informed, plan ahead, and make sound financial decisions to navigate any potential economic challenges.

| Generation | Financial Insecurity Factors | Statistic |

| Millennials & Gen Z | Student Loan Debt | – Over 60% of Millennials have student loan debt, with an average balance exceeding $30,000. Source: Education Data Initiative: https://educationdata.org/ <br> – Gen Z is also entering the workforce with significant student loan burdens. |

| Millennials & Gen Z | Housing Affordability | – Rising housing costs make homeownership increasingly difficult for younger generations. |

| Millennials & Gen Z | Job Market & Wages | – Concerns exist about stagnant wages and limited job security impacting financial stability. |

| Baby Boomers | Stagnant Wages & Rising Costs | – While nearing retirement, many Baby Boomers haven’t saved enough due to stagnant wage growth over their careers. |

| Baby Boomers | Healthcare Costs | – Rising healthcare costs are a major concern for Baby Boomers nearing retirement, potentially straining their budgets. |

| Baby Boomers | Long-Term Care Costs | – The potential for high long-term care expenses adds another layer of challenge for Baby Boomers on fixed incomes. |

Strategies for Building Financial Security

Despite the challenges, it’s important to remember that financial insecurity is not a life sentence. There are strategies that individuals can employ to build financial security. Here are some actionable tips:

Budgeting and Expense Tracking

Creating a budget and tracking expenses is a fundamental step toward financial security. It allows you to understand where your money is going and identify areas where you can cut back. There are numerous apps and tools available that can help with this.

Debt Management Strategies

Managing debt effectively is crucial. This might involve consolidating your debts, negotiating lower interest rates, or creating a debt repayment plan. It’s also important to understand the difference between ‘good’ and ‘bad’ debt.

Saving and Investing Options

Saving and investing are key to building financial security. Even small amounts can add up over time due to the power of compound interest. Consider different saving and investing options, such as high-yield savings accounts, retirement accounts, and low-cost index funds.

Exploring Career Advancement Opportunities

Career advancement can lead to higher income, which can help build financial security. This might involve seeking promotions, improving your skills through education or training, or even considering a career change.

In conclusion, while the rise of financial insecurity is a significant concern, it’s not insurmountable. With the right strategies and a proactive approach, individuals can build financial security. Remember, every journey begins with a single step. So, take that first step today towards your financial security.

Call to Action

We’ve explored the rise of financial insecurity in America, its causes, and its impacts. But this conversation doesn’t end here. We encourage you to share your experiences with financial insecurity in the comments section below. Your stories can help others feel less alone and can foster a community of support and understanding.

There are numerous resources available for financial education and support. Websites like the National Foundation for Credit Counseling offer free or low-cost advice on managing money and dealing with debt. Nonprofits like the Financial Health Network work to improve financial health for all. We encourage you to explore these resources and take advantage of the support they offer.

Finally, if you found this article helpful and want to learn more about personal finance topics, consider subscribing to our blog. We regularly post articles on budgeting, saving, investing, and more. Together, we can navigate the challenges of financial insecurity and build a more secure future.

Remember, financial security is not a destination, but a journey. Every step you take towards it, no matter how small, is a step in the right direction.

Frequently Asked Questions

Q1: What is financial insecurity?

Financial insecurity refers to the state of uncertainty about one’s ability to meet basic financial needs. It can manifest as living paycheck to paycheck, struggling with debt, or worrying about future financial stability.

Q2: What are the main factors contributing to financial insecurity?

Several factors contribute to financial insecurity, including rising inflation and cost of living, stagnant wages, increasing student loan debt, the changing nature of work, and unexpected economic events.

Q3: How does financial insecurity affect mental health?

Financial insecurity can have a significant impact on mental health, leading to stress, anxiety, and depression. Chronic financial stress has also been linked to serious health conditions such as migraines, heart disease, diabetes, and sleep problems.

Q4: Are certain regions or demographics more affected by financial insecurity?

Yes, financial insecurity tends to be more prominent in certain regions or demographics, such as rural areas, low-income communities, and specific age groups. Factors like job opportunities, cost of living variations, and access to social safety nets contribute to these disparities.

Q5: Are we headed for a financial crisis?

The potential for a recession or economic downturn is a topic of ongoing debate among economists. While some experts predict a recession, others suggest a ‘soft landing’ or slight contraction. It’s important to stay informed and make sound financial decisions.

Q6: What strategies can individuals employ to build financial security?

Strategies for building financial security include budgeting and expense tracking, effective debt management, saving and investing, and exploring career advancement opportunities. Remember, financial security is a journey, and every step towards it is a step in the right direction.

Disclaimer

This blog post is for informational purposes only and does not constitute financial advice. The information is provided in good faith, but we make no representation or warranty of any kind regarding its accuracy, adequacy, validity, reliability, availability, or completeness. Any action you take based on the information in this blog post is strictly at your own risk. We recommend consulting with a licensed financial advisor or other qualified professionals before making any financial decisions. Please note that this post may contain links to third-party websites, that are not controlled, maintained, or endorsed by us. We are not responsible for the content, policies, or practices of these third-party sites.