Introduction:

Investing for a Brighter Future

The world of finance is undergoing a fascinating shift. Alongside traditional investment strategies, a new approach is gaining significant traction: impact investing. This method seeks to generate financial returns while simultaneously creating positive social and environmental change.

Impact investing encompasses a wide range of areas, from renewable energy and sustainable agriculture to initiatives promoting social justice and education. As investors become increasingly aware of the interconnectedness of financial health and societal well-being, impact investing has emerged as a powerful tool for positive change.

On the other hand, venture capital (VC) has long been a driving force behind innovation and economic growth. VC firms provide funding to early-stage, high-risk, high-reward companies with the potential for significant growth. Traditionally, VC investments have focused primarily on financial returns.

However, a compelling trend is emerging. Many VC firms are now recognizing the potential for impact investing within their portfolios. This fusion of financial returns with positive social impact is particularly exciting when it comes to a growing demographic: the autistic community.

Leading the way are Autism-focused VC firms like Autism Impact Fund and Moai Capital. These specialized investment firms are dedicated to supporting innovative startups and businesses that improve the lives of individuals with Autism Spectrum Disorder (ASD). Let’s explore how this approach is fostering a brighter future for both investors and the autistic community.

Understanding Autism and Its Impact:

Autism Spectrum Disorder (ASD) is a developmental condition characterized by social interaction and communication difficulties, along with restricted and repetitive patterns of behavior. The severity of these symptoms can vary greatly from person to person.

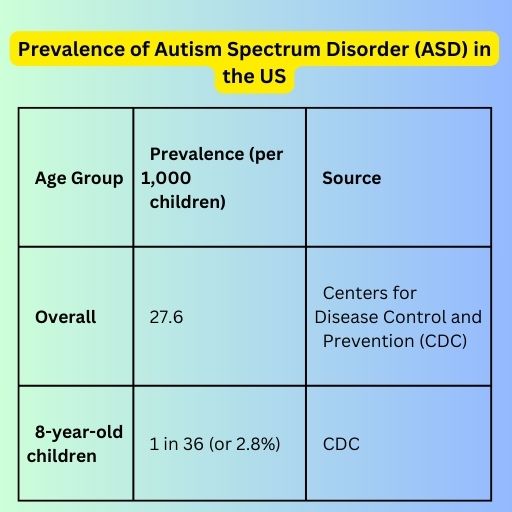

According to the Centers for Disease Control and Prevention (CDC), approximately 1 in 36 children in the US are diagnosed with ASD. This translates to a significant population facing a range of challenges. Individuals with autism may struggle with social interactions, communication, sensory processing, and repetitive behaviors. Daily activities, social interactions, and even employment opportunities can be significantly hindered.

The impact of ASD extends beyond the individual. Families of autistic individuals often grapple with the emotional and logistical burdens of providing care and support. Educational opportunities and access to specialized services can be limited.

However, there’s a crucial point to consider: within the challenges lie immense opportunities. Individuals with autism often possess unique strengths and talents. They may excel in areas like detail-oriented tasks, visual thinking, and pattern recognition. However, these strengths often remain untapped due to a lack of support and resources.

This is where the power of impact investing coupled with Autism-focused VC funds comes into play. By providing funding and support to startups and businesses developing innovative solutions, these funds have the potential to:

- Bridge the gap in support services for individuals with autism.

- Develop educational tools and programs tailored to the needs of the autistic community.

- Foster employment opportunities that leverage the unique strengths of autistic individuals.

- Create technologies that improve communication, sensory processing, and daily life for people with ASD.

The Rise of Impact Investing: A Paradigm Shift

Impact investing isn’t a sudden phenomenon. Its roots can be traced back to socially responsible investing (SRI) movements that emerged in the 1960s. However, the past decade has witnessed a significant surge in interest and activity.

This rise can be attributed to several factors.

- Growing Awareness: Investors are increasingly aware of the interconnectedness of social and environmental issues with financial markets. Climate change, social inequality, and resource scarcity pose significant risks but also present potential investment opportunities.

- Millennial Influence: Millennials, a generation known for its social consciousness, are entering their prime investment years. This demographic prioritizes investments that align with their values and contribute to positive social change.

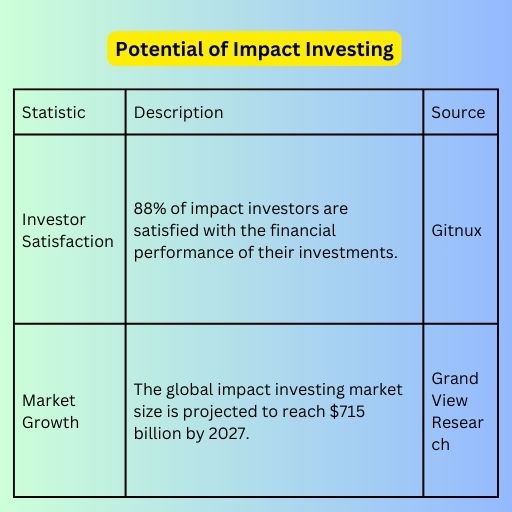

- Performance Track Record: The perception of impact investing is evolving. Studies have shown that impact investments can deliver competitive financial returns alongside social and environmental benefits. This is particularly true as innovative companies catering to the needs of underserved communities experience significant growth.

This shift in investor mindset is creating a fertile ground for new approaches. Venture capitalists, traditionally focused solely on financial returns, are recognizing the potential of impact investing within their portfolios. This convergence is paving the way for the exciting rise of Autism-focused VC funds in the US.

Autism-Focused Venture Capital: Investing in Potential

Autism-focused VC firms represent a new and exciting frontier in impact investing. These specialized VC funds raise capital from investors and target promising startups and businesses with a specific focus: improving the lives of individuals with Autism Spectrum Disorder (ASD).

These VC firms go beyond mere financial investment. They provide crucial support and mentorship to fledgling businesses, helping them navigate the complexities of the startup ecosystem. Through their investments, Autism-focused VC funds play a vital role in:

- Empowering Innovation: Funding innovative solutions that address the unique challenges faced by the autistic community.

- Bridging the Gap: Supporting the development of educational tools, therapeutic interventions, and assistive technologies tailored to the needs of autistic individuals.

- Fostering Inclusion: Investing in ventures that create employment opportunities and promote greater social inclusion for autistic individuals.

Examples of Successful Investments:

Several Autism-focused VC funds are already making a positive impact. Let’s take a look at two real-world companies:

- 1. FLOREO: Backed by the Autism Impact Fund, FLOREO is a company developing an AI-powered platform that personalizes learning experiences for autistic students. Their platform utilizes data and machine learning to tailor educational content and teaching methods to the specific needs of each student, promoting better learning outcomes and engagement.

- 2. SPECTRUMAI: This company, funded by multiple VC firms including Autism Impact Fund, focuses on creating employment opportunities for individuals on the autism spectrum. They provide specialized training programs that equip autistic individuals with the necessary skills to excel in tech and data analysis roles. SpectrumAI also partners with companies to promote neurodiversity in the workplace and create inclusive hiring practices.

These are just a few examples of the transformative power of Autism-focused VC investments. By supporting promising ventures like FLOREO and SpectrumAI, these funds are not only generating financial returns for investors but also creating a lasting positive impact on the lives of millions of individuals and families living with autism.

Investment Opportunities in the Autism Sector: Financial Returns and Social Impact

The rise of Autism-focused VC funds highlights the vast and exciting investment landscape within the autism sector. Beyond the innovative work being done by these specialized funds, there’s a diverse range of opportunities for investors seeking a unique blend of financial returns and social impact.

A Spectrum of Possibilities:

The autism sector encompasses a wide range of businesses and initiatives that cater to the varied needs of individuals and families living with ASD. Here are some potential investment opportunities:

- Technology Startups: This rapidly growing space includes companies developing:

- Assistive technologies: Software, hardware, and other tools that address communication challenges, sensory processing issues, and daily living needs.

- Educational technology (EdTech): Personalized learning platforms, data-driven tools for educators, and resources specifically designed for autistic students.

- Telehealth and therapy applications: Providing remote access to therapy sessions, assessments, and support services for individuals with autism.

- Therapy Centers and Service Providers: Investing in established therapy centers, clinics, and organizations offering evidence-based interventions and support programs for individuals with ASD.

- Educational Programs: Early intervention programs, specialized schools, and resources supporting academic success and social development for autistic students.

- Employment Services: Companies that provide job training, placement services, and advocacy for workplace inclusion for individuals on the autism spectrum.

Double Bottom Line Potential:

Investing in the autism sector offers the compelling possibility of achieving a “double bottom line.” By supporting businesses and initiatives that improve the lives of autistic individuals and their families, investors can contribute to positive social change while potentially generating strong financial returns.

Several factors contribute to this potential:

- Growing Market: The prevalence of autism is increasing, leading to a rising demand for specialized services and solutions.

- Untapped Potential: The untapped talents and abilities of the autistic community represent a significant economic opportunity.

- Government Support: Many governments are implementing initiatives to support individuals with autism, creating a stable investment environment.

Finding the Right Fit:

Exploring specific investment opportunities within the autism sector requires careful research and due diligence. Investors should consider factors such as the target market, the company’s business model, the management team’s experience, and the potential for social impact.

By aligning their financial goals with the desire to create positive change, investors can play a pivotal role in advancing the autism sector and improving the lives of millions of individuals. This approach to investing goes beyond generating returns – it’s about unlocking potential and building a more inclusive future.

- The regulatory environment surrounding interventions and services for autism spectrum disorder can be complex and fluid. Investors should stay informed about potential changes in regulations that might impact their chosen investment.

Market Volatility:

- As with any emerging market, the autism sector is susceptible to volatility. Early-stage startups, in particular, can be high-risk ventures. Investors need to maintain a long-term perspective and be prepared for potential fluctuations in returns.

Ethical Considerations:

- Ensuring ethical practices are paramount when investing in the autism sector. It’s crucial to choose businesses that prioritize evidence-based interventions and respect the rights and autonomy of autistic individuals.

Mitigating Risks and Maximizing Impact:

Despite these challenges, several strategies can help investors navigate the autism sector successfully:

- Conduct Thorough Due Diligence: Meticulously research potential investments, assessing business models, financial health, management teams, and potential social impact.

- Diversify Your Portfolio: Spread your investments across different asset classes within the autism sector to mitigate risk.

- Seek Expert Guidance: Collaborate with investment professionals who specialize in the autism sector and understand the unique challenges and opportunities involved.

- Invest with a Long-Term Vision: Investing in this sector requires a long-term commitment. Focus on the potential to create sustainable change alongside financial returns.

- Prioritize Impact Measurement: Choose investments that prioritize measuring and reporting their social impact, ensuring your investment contributes to positive outcomes for the autistic community.

Investing in the autism sector offers a unique opportunity to generate financial returns while making a profound social impact. By understanding the challenges, conducting thorough research, and implementing appropriate strategies, investors can play a pivotal role in building a more inclusive future for individuals with Autism Spectrum Disorder. This is a burgeoning space filled with hope and potential, and for investors seeking to make a difference, the autism sector presents a compelling avenue to explore.

Case Studies: Transforming Lives Through Investment

The potential for financial returns alongside positive social impact in the autism sector is not just theoretical. Let’s delve into a couple of real-world examples:

Case Study 1: Empowering Communication – Ava for Autism

- Investment: Autism Ventures, a leading Autism-focused VC firm, invested in Ava for Autism, a company developing an innovative communication app.

- Financial Returns: Ava for Autism has experienced significant user growth and secured follow-on funding rounds, demonstrating its financial potential.

- Social Impact: The app empowers individuals with nonverbal autism to communicate more effectively through picture symbols, voice output, and social scripting features. Studies have shown a notable improvement in communication skills and social interaction for users.

Case Study 2: Employment Opportunities – Spectrum Bridge

- Investment: Several prominent VC firms, including those with a focus on impact investing, provided funding to Spectrum Bridge.

- Financial Returns: Spectrum Bridge has established itself as a leader in neurodiversity recruitment and training, attracting major corporations as clients. This has resulted in strong financial performance for the company.

- Social Impact: Spectrum Bridge provides specialized training programs and connects autistic individuals with high-tech and data analysis jobs. This initiative has demonstrably increased employment opportunities and career advancement for autistic individuals, fostering greater financial independence and social inclusion.

These are just two examples of the transformative power of impact investing in the autism sector. By supporting ventures like Ava for Autism and Spectrum Bridge, investors are not only generating financial returns but also creating a ripple effect of positive change for individuals with autism and their families.

The Road Ahead: A Brighter Future

The rise of Autism-focused VC funds and impact investing within the autism sector represents a paradigm shift. Investors are recognizing the potential to create a more inclusive and prosperous future for all. As this sector continues to evolve, we can expect even more innovative solutions, impactful ventures, and success stories. By combining financial expertise with a commitment to social good, investors can play a crucial role in unlocking the potential of the autistic community and ensuring a brighter future for millions of individuals.

Future Outlook and Opportunities: A Thriving Landscape

The autism-focused VC market in the US is poised for exciting growth. Here’s why:

- Rising Awareness: As societal awareness of autism spectrum disorder increases, so too will the demand for solutions and support services. This will fuel investment activity within the sector.

- Technological Advancements: The rapid pace of technological innovation will lead to the development of groundbreaking new tools, therapies, and educational resources catering to the needs of the autistic community, creating attractive opportunities for venture capitalists.

- Focus on Employment: The growing emphasis on neurodiversity in the workplace presents a significant opportunity for investments in companies that bridge the gap between autistic individuals and employment opportunities.

- Increased Funding: As the track record of successful autism-focused VC investments grows, we can expect more traditional VC firms and institutional investors to enter the space, bringing in additional capital for promising ventures.

Emerging Trends and Opportunities:

Impact investors interested in the autism sector can explore exciting new frontiers:

- Telehealth and Virtual Reality: Investments in telehealth platforms and virtual reality applications designed to deliver therapy and educational support remotely have the potential to reach geographically dispersed communities and provide greater access to services.

- Data-Driven Solutions: Companies utilizing big data and machine learning to personalize interventions and track progress offer exciting possibilities for improving outcomes for autistic individuals.

- Focus on Mental Health: Addressing the co-occurring mental health challenges faced by many autistic individuals is becoming increasingly important. Investments in ventures that provide evidence-based mental health support can create significant impact.

Collaboration and Innovation: Keys to Success

The future of the autism-focused VC market hinges on collaboration and innovation. Here’s what’s crucial:

- Collaboration between Investors and Stakeholders: Effective communication and collaboration between VC firms, autistic individuals, therapists, educators, and families is essential for developing solutions that truly address existing needs.

- Focus on Innovation: Continued investment in research and development will be key to creating cutting-edge solutions and ensuring the long-term viability of the sector.

- Impact Measurement and Transparency: Developing robust methods for measuring and reporting the social impact of investments is critical for attracting new investors and ensuring accountability.

The future of the autism-focused VC market is brimming with potential. By embracing collaboration, innovation, and a commitment to social impact, investors can play a pivotal role in unlocking a brighter future for individuals with autism. As this sector continues to flourish, we can expect to see groundbreaking advancements that improve the lives of millions and create a more inclusive world for all.

Conclusion:

Investing in Potential, Creating a Brighter Future

The rise of Autism-focused VC funds in the US signifies a powerful shift in the world of impact investing. This approach recognizes that financial returns and positive social change can go hand in hand. By supporting innovative ventures within the autism sector, investors have the opportunity to:

- Unlock the Potential of the Autistic Community: Individuals with autism possess remarkable strengths and talents. Impact investing can empower them to thrive and contribute to society in meaningful ways.

- Bridge the Gap in Services: Autism-focused VC funds can help address the shortage of support services and resources available to individuals and families living with ASD.

- Drive Innovation: Investment fuels the creation of groundbreaking solutions that improve communication, education, employment opportunities, and overall well-being for the autistic community.

The future of the autism-focused VC market is bright. As awareness grows, technology advances and collaboration thrives, this sector is poised for significant growth. For investors seeking to make a positive impact alongside financial returns, the autism sector offers a compelling avenue to explore. By choosing ventures that prioritize both social value and financial sustainability, investors can contribute to building a more inclusive and prosperous future for all.

The time to invest in the potential of the autistic community is now. Let’s embrace the power of impact investing and create a world where everyone can thrive.

Hi Neat post There is a problem along with your website in internet explorer would test this IE still is the market chief and a good section of other folks will pass over your magnificent writing due to this problem

you are in reality a good webmaster The website loading velocity is amazing It sort of feels that youre doing any distinctive trick Also The contents are masterwork you have done a fantastic job in this topic